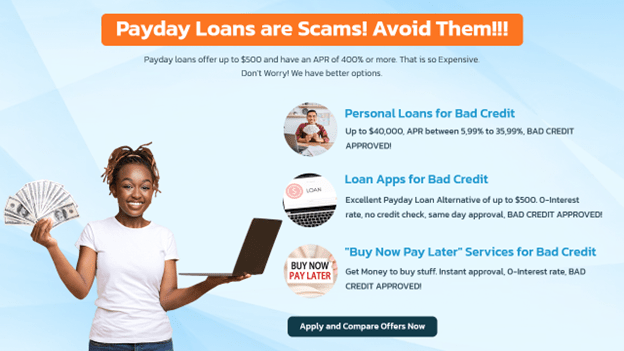

Whether it’s a looming deadline on a medical bill or unexpected auto repair, those with bad credit often have a difficult time with predatory rates offered by payday, auto title, and pawnshop lenders. Fortunately, there are much better options out there with same day, near guaranteed approval payday loans online offering up to $40,000, excellent sub 35.99% APRs, longer repayment terms, and no loan extension fees.

Best 5 Same Day Payday Loans Online for Bad Credit No Credit Check

MoneyMutual – Up to $5,000 / Min. Credit Score: 0 / 5 Minute Approval / Rating: 4.9/5.0 – Best for Bad Credit Loans Guaranteed Approval up to $5,000

ZippyLoans – Up to $15,000 / Min. Credit Score: 0 / 5 Minute Approval / Rating:4.8/5.0 – Best Instant Payday Loans for Bad Credit

FundsJoy – Up to $5,000 / Min. Credit Score: 0 / 5 Minute Approval / Rating: 4.8/5.0 – Best for Quick Bad Credit Loans Guaranteed Approval

LifeLoans – Up to $40,000 / Min. Credit Score: 0 / 5 Minute Approval / Rating: 4.6/5.0 – Best for No Credit Check Payday Loans for Bad Credit

NextDayPersonalLoans – Up to $40,000 / Min. Credit Score: 0 / 5 Minute Approval / Rating: 4.5/5.0 – Best for Personal Bad Credit Loans Guaranteed Approval

If you are interested in a same day, better than payday loan, you have come to the right place. Keep reading to learn more about same day loans and quick cash opportunities, including four highly recommended lending networks, tips on improving bad credit, how to find/qualify for same day loans online, and a word on 0% interest paycheck advance apps.

Before we move on, see this video. It explains all about bad credit loans.

![]()

Rating: 4.9/5.0

Amount: $200 to $5,000

APR: Up to 35.99%

Min. Credit Score: 0

Approval: 5 Minutes

Las Vegas-based Money Mutual is among the top three most popular lending networks today.

Its top three status exists thanks to its well-rounded near guaranteed approval loan product and service offerings. It connects bad credit borrowers with legit participating direct lenders offering loans between $200 and $5,000 to sub-35.99% APRs. These loans can be used for emergency expenses, including medical bills, automotive repairs, unexpected utility bills, and even celebratory occasions like weddings or an impromptu trip to Disney World.

Another thing we appreciate about Money Mutual is its sheer size, with more than 2 million customers served to date. In addition, its speedy transactions (money to your account in as little as 24 hours) and secured 256-bit encrypted online form only take less than five minutes to complete, offering a vital lifeline for those looking for emergency cash quickly.

How to Apply: It only takes 5 minutes to submit a MoneyMutual loan request form to be matched with several legit participating direct lenders. To get started, visit the homepage and click on the bright orange “Get Started” button, where you will answer a series of questions regarding your contact information, depositing instructions, and more. Once submitted and approved, expect same-day approval and funding to your bank account as early as the next business day.

Eligibility:

- 18 years of age or older

- S. citizen or permanent resident

- Minimum monthly income of $800 a month

- Valid checking account

- Not a resident of Connecticut

- Completed application through the MoneyMutual portal

Highlights:

- Loans from $200 to $5,000

- More than 2MM customers to date

- Excellent source of payday same day loans online and same day loans no credit check

- Easy and fast 5-minute application process

- Member of the Online Lenders Alliance (OLA)

- Funds to your bank account in as little as 24 hours

Fees:

- No origination or prepayment penalties on near guaranteed approval loans

- Late, insufficient funds, and loan extension fees depend on the lender

Pros:

- Loans from $200 to 5,000

- APRs up to 35.99%

- Flexible repayment terms

- Solid source of same day cash loans

- No origination or prepayment penalties

- Loose qualification criteria

- Insightful Bad Credit Loans guide with helpful information

Cons:

- Not a direct lender

- Eligibility requirements vary by direct lender

- Not available to Connecticut residents

Terms: MoneyMutual offers a variety of loan products to consumers, including bad credit installment loans, high-risk personal loans, instant online cash advances, and personal loans for bad credit. These loans range in amount from $200 to $5,000 with Annual Percentage Rates (APRs) of up to 35.99%. Repayment terms can extend up to 60 months. As MoneyMutual operates as an online marketplace rather than a direct lender, the specific fees associated with each loan, such as origination fees, prepayment fees, late payment fees, insufficient funds fees, and rollover/extension fees, are determined by the participating direct lenders.

For a better understanding of the potential interest charges (APRs) and fees applicable to your loan, let’s consider an example. Suppose you were to borrow $3,600 with a 22% APR, on a 2-year repayment term, and without any finance charges. In this scenario, your total payment would amount to $4,482.27, with estimated monthly payments of $186.76. Over the course of the loan, you would incur $882.27 in total interest charges.

Be sure to carefully review the terms and conditions provided by each direct lender through MoneyMutual’s platform to ensure you understand all associated costs and obligations before signing on the dotted line.

![]()

Rating: 4.8/5.0

Amount: $100 to $15,000

APR: Up to 35.99%

Min. Credit Score: 0

Approval: 5 Minutes

If you need to pay an emergency medical or utility bill, look no further than ZippyLoans as your next same day loans with no credit check source.

Participating direct lenders on the ZippyLoans offer short-term loans up to $15,000 with better terms than traditional payday loans, long known as debt traps. For example, APRs range from 12% to 35.99% with repayment terms of up to 60 months and no minimum required credit score. Moreover, prospective borrowers can be approved on the platform in as little as five minutes.

One of the biggest advantages of ZippyLoans over traditional payday loans is an easier online application process offering near guaranteed approval. You no longer need to visit a payday loan store and issue post-dated checks to take out a loan. Instead, complete the online form and get matched with legit direct lenders offering same day approval and funding by the next business day.

How to Apply: It takes at least five minutes to complete a ZippyLoan application for same day loans for bad credit. On the homepage, click the “Get Started” button to start your application, submitting your desired loan amount and all contact/deposit information to be matched with several direct lenders matching your borrower profile.

Eligibility:

- 18 years of age or older

- Government-issued photo ID

- Valid bank account

- Need to earn a minimum of 800 a month

- Completed ZippyLoan online application

- Not a NY, OR, WV, or Washington DC resident

Highlights:

- Loans up to $15,000

- APRs from 12% to 35.99%

- Extensive network of same day loan companies

- Excellent source of same day loans for bad credit

- Plenty of near guaranteed approval loan opportunities

Fees:

- No origination fees

- No prepayment penalties

- No loan extension renewal fees

- Late and insufficient funds fees depend on the lender

Pros:

- Loans from $100 to $15,000

- No need to put up collateral

- No credit minimum

- Same day approval and fast funding

- Strong source of same day cash loans

Cons:

- No cosigner or co-borrower loan options

- Not available in all states (excludes New York, Oregon, West Virginia, and Washington DC)

- Information may be shared with third parties advertising their loan products and services

Terms: ZippyLoan offers a variety of loan products to consumers, including bad credit installment loans, high-risk personal loans, instant online cash advances, and personal loans for bad credit. These loans go up to $15,000 with Annual Percentage Rates (APRs) of up to 35.99%. Repayment terms can extend up to 60 months. As ZippyLoan operates as an online marketplace rather than a direct lender, the specific fees associated with each loan, such as origination fees, prepayment fees, late payment fees, insufficient funds fees, and rollover/extension fees, are determined by the participating direct lenders.

For a better understanding of the potential interest charges (APRs) and fees applicable to your loan, let’s consider an example. Suppose you were to borrow $12,900 with a 31% APR, on a 3-year repayment term, and without any finance charges. In this scenario, your total payment would amount to $19,969.73, with estimated monthly payments of $554.71. Over the course of the loan, you would incur $7,069.73 in total interest charges.

Be sure to carefully review the terms and conditions provided by each direct lender through the ZippyLoan platform to ensure you understand all associated costs and obligations before signing on the dotted line.

![]()

Rating: 4.8/5.0

Amount: $100 to $5,000

APR: Up to 35.99%

Min. Credit Score: 0

Approval: 5 Minutes

FundsJoy is one of the more well-rounded lending networks, an excellent source of same-day payday loans online for bad credit/same day loans no credit check.

FundsJoy direct lenders offer loans up to $5,000 with great sub-35.99% APRs. Additionally, repayment terms are much longer than traditional payday, auto title, and pawn shop loans, topping 60 months in some cases. An easy five-minute online application also allows prospective borrowers to submit loan requests for same-day approval and funding to checking accounts as early as the next business day.

Our only negative feedback on FundsJoy is that it has a lower maximum borrowing limit ($5,000) than the other three recommended lending networks on our list. However, it can fulfill $255 payday loans online same day. Thanks to its ease of use, transparency, and expansive legit direct lender network, FundsJoy is worth considering.

How to Apply: It is very easy to get started with same day loans for bad credit from FundsJoy. First, visit the homepage and navigate to the upper navigation. Click on the purple “Get Started” button and follow all instructions answering each question truthfully. Once you submit a loan application for same day cash loans, you will be matched with several direct lenders who can offer you your next loan. Review each direct lender’s fine print before signing off on any loan.

Eligibility:

- 18 years of age

- US citizen or permanent resident

- Government-issued photo ID

- Valid bank account

- $800 and minimum monthly income

- Completed FundsJoy loan request

Highlights:

- Loans up to $5,000

- 99% to 35.99% APRs

- Repayment terms up to 60 months

- Fast cash loans online same day deposit

- Excellent source of same day loans

Fees:

- Origination, prepayment, and late/insufficient fees vary by lender

Pros:

- Loans up to $5,000

- Excellent APR range (5.99% to 35.99%)

- Solid source of quick loans same day

- Transparent disclaimers on the website

- Easy qualification criteria

- Ideal for bad credit borrowers

- Legit network of loan providers

- Excellent source of near guaranteed approval loans

Cons:

- Mainly a source of unsecured loans, not secured same day cash loans

- No cash advance options

- Not all lenders will approve your desired loan amount

Terms: FundsJoy offers a variety of loan products to consumers, including bad credit installment loans, high-risk personal loans, instant online cash advances, and personal loans for bad credit. These loans go up to $5,000 with Annual Percentage Rates (APRs) of up to 35.99%. Repayment terms can extend up to 60 months. As FundsJoy operates as an online marketplace rather than a direct lender, the specific fees associated with each loan, such as origination fees, prepayment fees, late payment fees, insufficient funds fees, and rollover/extension fees, are determined by the participating direct lenders.

For a better understanding of the potential interest charges (APRs) and fees applicable to your loan, let’s consider an example. Suppose you were to borrow $2,400 with a 28% APR, on a 1-year repayment term, and without any finance charges. In this scenario, your total payment would amount to $2,779.37, with estimated monthly payments of $231.61. Over the course of the loan, you would incur $379.37 in total interest charges.

Be sure to carefully review the terms and conditions provided by each direct lender through FundsJoy platform to ensure you understand all associated costs and obligations before signing on the dotted line.

![]()

Rating: 4.6/5.0

Amount: $100 to $40,000

APR: Up to 35.99%

Min. Credit Score: 0

Approval: 5 Minutes

True to its “a fast and easy way to find a loan” tagline, LifeLoans is one of the more reputable online lending networks for same day loans no credit check we’ve come across.

To begin, lenders on the platform are willing to offer loans from $100 to $40,000, which covers a wide range of expenses from small utility bills to large weddings. In addition, we appreciate its easy online application process with a 256-bit encryption online form to protect your privacy and safeguard your data.

One of LifeLoan’s biggest draws is its instant approval and next business day funding. It provides all the benefits of traditional payday loans without exorbitant APRs and ongoing renewal fees, pitting borrowers into a vicious debt cycle that may take months or years to get out of. We wholeheartedly recommend LifeLoans for your short-term emergency cash needs

How to Apply: LifeLoans makes signing up for same day loans for bad credit very easy. Click the “Start Now” button on the homepage and follow all the on-screen instructions. Be sure to consent to its terms of use, privacy policy, and advertiser disclosures before completing your loan documentation.

Eligibility:

- 18 years of age or older

- US citizen or permanent resident

- Need to earn at least $1,000 a month

- Not a resident of Connecticut, New Hampshire, Washington, and Vermont

- Completed LifeLoans online application

Highlights:

- Loans up to $40,000

- APRs up to 35.99%

- Excellent source of same day loans

- Available in almost all 50 states

- Fast cash loans online same day deposit

- Does not rely on just your credit score

Fees:

- No origination or prepayment penalties

- Late and insufficient funds fees vary by lender

Pros:

- Instant approval on loans up to $15,000

- 12% to 35.99% APRs

- Excellent source of quick loans same day

- 256-bit encryption and 100% online form

- Suitable for all credit types

- Member of the Online Lenders Alliance

Cons:

- Not a direct lender

- No secured same day cash loans option

- Transparency with rates and terms vary by lender

- Not all direct lenders will approve your requested loan amount

- Connecticut, New Hampshire, Washington, and Vermont residents are not eligible for a loan

- Excludes former and current military personnel from applying

Terms: LifeLoans offers a variety of loan products to consumers, including bad credit installment loans, high-risk personal loans, instant online cash advances, and personal loans for bad credit. These loans go up to $40,000 with Annual Percentage Rates (APRs) of up to 35.99%. Repayment terms can extend up to 60 months. As LifeLoans operates as an online marketplace rather than a direct lender, the specific fees associated with each loan, such as origination fees, prepayment fees, late payment fees, insufficient funds fees, and rollover/extension fees, are determined by the participating direct lenders.

For a better understanding of the potential interest charges (APRs) and fees applicable to your loan, let’s consider an example. Suppose you were to borrow $9,000 with a 21% APR, on a 3-year repayment term, and without any finance charges. In this scenario, your total payment would amount to $12,206.72, with estimated monthly payments of $339.08. Over the course of the loan, you would incur $3,206.72 in total interest charges.

Be sure to carefully review the terms and conditions provided by each direct lender through the LifeLoans platform to ensure you understand all associated costs and obligations before signing on the dotted line

![]()

Rating: 4.5/5.0

Amount: $100 to $40,000

APR: Up to 35.99%

Min. Credit Score: 0

Approval: 5 Minutes

If you’re looking for a fast emergency source of quick cash for unexpected expenses, then NextDayPersonalLoans is an excellent option.

NextDayPersonalLoans direct lenders are open to offering loans from $100 to $40,000 with APRs up to 35.99%, representing the maximum threshold for bad credit borrowers before entering predatory rate territory. In addition, we appreciate its repayment terms, as high as 72 months in some cases, offering an opportunity to manage your budget with lower monthly installments better.

Another benefit to NextDayPersonalLoans is its quick and easy online application that takes no more than five minutes to complete. Provide all of your contact and financial details, and you will be paired with a network of legit and qualified lenders shortly after that.

How to Apply: Applying for same day loans for bad credit/same day loans no credit check with NextDayPersonalLoans it’s so easy that even a seven-year-old could do it. Visit the homepage and click the orange “Start Now” or “Get Started” button to start your loan request. Filling out this application will not affect your credit score.

Eligibility:

- 18 years of age or older

- Government-issued photo ID

- Minimum monthly income of $1,000 a month

- Valid bank account

- Not a resident of Connecticut, New Hampshire, Washington, or Vermont

- Completed application through the NextDayPersonalLoans portal

Highlights:

- Loans up to $40,000

- APRs from 5.99% to 35.99%

- Fast cash loans online same day deposit

- No impact on credit score

- Better terms than payday, auto title, and pawnshop loans

- Excellent source of instant approval loans

Fees:

- Origination, prepayment, and late fees vary by lender

Pros:

- Loans from $100 to $40,000

- APRs up to 35.99%

- Flexible repayment options for up to 60 months

- Same day approval

- Next business day funding

- Member of the Online Lenders Alliance

Cons:

- Not available to Connecticut, New Hampshire, Washington, and Vermont residents

- Higher than average APRs

- No secured same day cash loans option

- No cash advance, cosigner, or co-borrower loans

- Mainly a source of unsecured loans

- Most lenders limit borrowing up to $10,000

Terms: NextDayPersonalLoans offers a variety of loan products to consumers, including bad credit installment loans, high-risk personal loans, instant online cash advances, and personal loans for bad credit. These loans go up to $40,000 with Annual Percentage Rates (APRs) of up to 35.99%. Repayment terms can extend up to 60 months. As NextDayPersonalLoans operates as an online marketplace rather than a direct lender, the specific fees associated with each loan, such as origination fees, prepayment fees, late payment fees, insufficient funds fees, and rollover/extension fees, are determined by the participating direct lenders.

For a better understanding of the potential interest charges (APRs) and fees applicable to your loan, let’s consider an example. Suppose you were to borrow $40,000 with a 14% APR, on a 5-year repayment term, and without any finance charges. In this scenario, your total payment would amount to $55,843.80, with estimated monthly payments of $930.73. Over the course of the loan, you would incur $15,843.80 in total interest charges.

Be sure to carefully review the terms and conditions provided by each direct lender through the NextDayPersonalLoans platform to ensure you understand all associated costs and obligations before signing on the dotted line.

What are Payday Online Loans?

Payday online loans generally go up to $500, typically repaid in two to four weeks. They can be used for all expenses, including unpaid medical bills, past due utility bills, or even a small gift to a loved one.

Traditional payday loans charge up to $30 for every $100 borrowed, translating to 400%+ APRs. This does not include rollovers or loan extension fees. The number one predatory type of loan, more and more consumers are turning away from payday loans and going for more flexible same day payday loans online for bad credit with no credit checks.

Thanks to traditional payday loans’ predatory practices, this type of loan is illegal in 19 states. In states where payday loans are legal, strict regulations limit borrowing amounts, APRs, repayment terms, and other vital details. Regardless, this is not a good sign for any loan, including same day funding loans and secured same day cash loans.

Our favorite lending networks offer same-day payday loans online for bad credit borrowers with no minimum required credit score. Instead, it accepts 300 to 580 credit scores with open arms, promising sub 35.99% APRs, flexible repayment terms (up to 60 months), and no prepayment and origination fees.

Are There Payday Loans for Bad Credit and No Credit Checks?

Yes, plenty of instant approval loans are available geared toward bad credit borrowers with no minimum required credit score.

Qualification criteria for these types of same day personal loans are different. Rather than a credit score, direct lenders that online marketplaces like ZippyLoans and MarketLoans assess your ability to repay mainly through proof of income. To qualify for a same-day payday loan online, expect to earn a minimum of $800 a month with four consecutive weeks of employment to qualify.

Do Payday Lenders Approve Same Day Loans?

Almost all direct lenders at our recommended online marketplaces offer same day approval and next business day funding. All you need to do is submit a loan request and get approved by a daily 5:00 pm cut-off for this to happen.

As a vital source of emergency fast cash, we appreciate online lending networks like Money Mutual and ZippyLoan, which facilitate instant approval and funding to your bank account by the next business day. The only type of payday lender to issue funds quicker is 0% interest cash advance apps, but they are generally known more as paycheck advance services than actual lending opportunities.

With quick and easy five-minute online applications, those with limited credit history can quickly compare rates and terms from at least three direct lenders. Keep in mind that payday lenders have much looser eligibility requirements than traditional bank and credit union loans, requiring only being at least 18 years of age with a government-issued photo ID and a minimum monthly income of $800 a month—these loose requirements around even the worst credit borrower to have access to quick cash for emergency expenses.

Do Payday Same Day Loans Need A Deposit?

Payday same day loans do not require a deposit. Instead, payday lenders rely on your future paycheck to pay back your loan proceeds, including interest and finance charges. In addition, all payday same day loans require that the borrower repay their loan on the next payday.

Rather than a required deposit, payday same day loans borrowers must demonstrate that they earn a minimum monthly income (usually around $800). They must also have a valid bank account. Traditional and online same-day loan stores usually collect loan proceeds in two ways. The first is with an issued post-dated check, and the second is through an electronic withdrawal. To facilitate the second method, payday lenders are authorized by borrowers to make the withdrawal on the loan due date.

Speaking of deposits, another reason why traditional payday lenders are not a good option is that they can quickly force multiple overdrafts on your checking account, racking up lots of $35 fees in a hurry. On top of interest in finance charges, excessive withdrawal fees are another concern. It’s a stark difference versus 0% interest cash advance apps that offer built-in overdraft protection.

How to Find The Best Payday Same Day Loans Online for Bad Credit?

Here are our favorite strategies to find the best same day loans online/quick loans same day for bad credit:

Understand Your Need. The first step in finding the best payday same loans/same day personal loans online is to understand your need. How much do you want to borrow? What repayment term are you comfortable with? Are you looking for a small $500 loan on a two week repayment period or a large $9,000 loan you would prefer to pay out over several years?

Find Your Financial Footing. Once you have identified your desired payday loan’s loan amount and repayment term, perform a quick calculation. Will this new debt bring you above a 40% debt-to-income ratio with all principal, interest, and finance charges accounted for? Remember, 40% is universally recommended as an acceptable DTI. Will this new loan impact your ability to pay other lines of credit? If so, you may want to boost your credit score first before applying or pay off other outstanding balances to bring you to a good level.

Scout Online Marketplaces. After assessing the above, identify lending networks that offer the same day cash loans amount and repayment terms you need. For example, forget about $100 loans at LendingPoint or $30,000 loans at ZippyLoans (given their minimum and maximum borrowing limits). Be sure to check that they are licensed in your state also.

Submit Loan Requests. Now that you have scouted online marketplaces, feel free to submit a same day loans request on one or more sites. Once matched with a minimum of three direct lenders, you will be able to carefully review each one’s rates and terms to find the best one for your financial situation.

Understand No Credit Check Loans

It is very easy to explain how instant approval no credit check loans same day and quick loans same day work.

In short, no credit check same day loans work differently than the name implies. There’s no minimum required credit score, an excellent option for those with no credit history or 300 to 580 credit scores.

Qualification requirements for online no credit check loans mainly revolve around age and proof of income. To qualify, you must be 18 or older with a minimum monthly income of $800 and a valid bank account to disburse loan proceeds.

Benefits of no credit check, same day cash loans include quick access to funds, same day approval, flexible lending terms, and no required collateral, as they are mainly unsecured loans. Indirectly, they also allow you to improve your credit score over time, as many no credit check lenders report on-time payments to credit bureaus.

In short, we encourage anyone with limited to no credit history to consider no credit check loans/payday loans online same day deposit as their next funding source for most expenses from $100 up to $40,000.

What is the Difference Between Personal and Quick Payday Same Day Loans Online

The difference between personal and same day loans lies in interest rates, repayment terms, and type of direct lender.

First, personal loans are fixed installment loans offered by banks, credit unions, and online lenders to borrowers with poor to excellent credit. They generally come with higher borrowing limits and lower interest rates than same day payday loans online. Higher borrowing limits typically encourage paying off significant expenses such as home improvement projects and 150-person weddings.

Conversely, same-day payday loans online and no credit check loans same day are shorter-term loans up to $500 with two to four-week repayment terms, used for short-term emergency cash needs or to cover gaps between paychecks, repaid by your next payday.

However, a growing number of online marketplaces like ZippyLoans and MarketLoans have evened the playing field, providing same day payday loans online to bad credit borrowers with higher borrowing limits (up to $50,000) and APRs below 35.99%. Plus, online platforms after 256-bit encrypted online forms for users to submit loan requests.

All in all, lending networks like 100Lenders offering same day online payday loans/same day loans for bad credit are an excellent alternative to traditional payday loan stores that require borrowers to issue post-dated checks with the ever-looming threat of expensive overdraft and renewal fees.

How Can I Improve My Bad Credit?

Today, your FICO credit score is calculated based on five key factors: payment history, credit utilization ratio, length of credit history, types of credit, and new credit.

If you have extra time before your same day loans/quick loans same day application, we encourage you to bump your credit score with the following strategies.

Make On-Time Payments. With a payment history accounting for 35% of your FICO score, even a single missed payment could drop your credit score by 50 points or more, qualifying you from a 17% APR to a 35.99% APR. Over the life of a four-year, $25,000 loan, this APR difference could lead to several hundred dollars more in interest and finance charges.

Lower Your Credit Utilization. Your credit unionization ratio refers to the amount of credit relative to your limit. For example, a $20,000 maximum credit limit across three credit cards and a standing balance totaling $14,000 equals a 70% utilization ratio, well above FICO’s recommendation of under 30%.

The best way to lower your credit utilization for same day loans for bad credit is to pay off outstanding balances to zero each month. You can also apply the debt avalanche method, which prioritizes paying off debt with the highest interest rates first.

Never Close An Account. Even if your account has a zero balance, closing any account will shorten your average credit history. The longer you average account age, the less of a risk you post to lenders. Even if taking out same day loans, it is important to pay attention to this point.

Dispute Credit Reporting Errors. According to the Federal Trade Commission, one in five consumers discovers an error on their credit reports. These are not limited to overcharges but incorrect balances, wrong addresses, and open accounts marked as closer than other factors that could inadvertently lower your credit score. Although not tied to online loans same day (as it requires no credit check), doing this exercise will improve your rates for other lines of credit.

We encourage you to visit annualcreditreport.com and pull credit reports from the three major reporting bureaus, Equifax, TransUnion, and Experian. Carefully study each report with a magnifying glass, checking for errors. Any errors should be immediately disputed with the creditor or credit bureau. Expect to take up to 45 business days towards dispute resolution.

Alternatives to Payday Same Day Cash Loans

Here are our preferred alternatives to instant approval, same day loans for bad credit.

Payday Alternative Loans (PALs). Generally offered by online-only and branch-based credit unions like Navy Federal Credit Union and Alliant Credit Union, payday alternative loans are awarded by credit unions with loan amounts up to $2,000 with repayment terms of one to 12 months. Credit unions pay less attention to credit and more attention to the ability to pay with proof of income.

With APRs on alternative payday loans capped at 28%, it’s a good deal and alternative over online loans same day for bad credit borrowers accustomed to predatory rates from traditional quick loans same day.

Cash Advance Apps. The best cash advance apps are Earnin, Brigit, and Dave. All three platforms have gained hundreds of thousands of positive reviews, allowing users to borrow up to $100 a day or $750 per pay period at 0% interest. Other features include automatic overdraft protection, low account balance alerts, bill reminders, and credit monitoring.

How 0% cash advance apps like Earnin and Brigit work is straightforward. Start by downloading and installing your chosen app, creating an account (providing your basic information), and linking in your bank account so that the app can deposit funds into your account when you request in advance. There are also several steps to take, such as verifying your identity and income through proof like electronic timesheets, pay stubs, or bank statements.

Keep in mind that not everyone will qualify for the maximum advance amount. Many factors are considered, such as your income and banking history. However, you can expect funds to be deposited into your checking account as early as the same day (in exchange for a small Expediting fee) or within several days for free.

From there, you can expect to repay the advance with your next paycheck. Consider this strictly an option to cover paycheck gaps for minor expenses like past due electric bills, not larger expenses like home renovations or debt consolidation.

Buy Now, Pay Later (BNPL). BNPL services are payment solutions that allow consumers to split e-commerce purchases into equal, fixed installments. No longer do they need to provide the entire payment upfront. Instead, your favorite items like couches or rugs can be paid in bits over a specified period.

Three of the more popular BNPL services are Afterpay, Klarna, and Affirm. They are prevalent for their “Pay in 4” programs, allowing you to make the first installment at the time of purchase and the remaining three payments every two weeks with automatic bank deductions. All three boast hundreds of participating retailers like walmart.com and Amazon.

Benefits to using BNPL Services include financial flexibility, convenience, 0% interest financing, and an improved shopping experience, considering that BNPL options are available right on the checkout page, as long as you are within the pre-approved credit limits on qualified purchases. You do not need to go to a separate page.

As with all loans, be sure to use NPL Services responsibly, as one can quickly become overspending.

All of these are excellent lending network same day loans alternatives.

How Did We Pick These Lenders?

To pick our same day loan companies offering no credit checks, we reviewed more than 15 different lending networks. Our selection process was based on APRs, repayment terms, ease of use, and transparency.

To start, APRs were at the top, with our preferred online marketplaces featuring direct lenders ready to offer generous quick loans same day borrowing limits (usually $100 to $40,000) with sub 35.99% APRs. Anything above 35.99% is a recipe for disaster with lenders using predatory types assessing other outrageous fees.

Repayment term on quick loans same day should also be good up to 60 months (even longer in some cases). The longer the repayment term, the lower your monthly payment, but more interest accrued over time, so exercise caution.

Frequently Asked Questions

How can I get $255 payday loans online the same day?

Yes, getting a $255 payday loan online on the same day is possible. However, it is essential to distinguish between receipt of funds and loan approval. Direct lenders at MarketLoans, 100Lenders, and other lending networks offer same day approval, not instant funding.

If you need $255 payday loans online same day, go with a cash advances app like Earnin, Brigit, or Dave. You must ensure that it is repaid with your next paycheck, as these are paycheck advance services, not direct lenders.

How to get a same day loan?

To get a same day loan or $255 payday loans online same day, we encourage you to use cash advance apps like Earnin, Brigit, and Dave as long as it can be repaid with your next paycheck.

If you can wait up to 24 hours for funding (in exchange for higher borrowing limits and repayment terms of up to 60 months), you’d be better off with a bad credit direct lender from one of our recommended online marketplaces.

Are same day loans safe?

If it’s not a traditional payday, auto title, or pawn shop loan, then same day loans for bad credit/quick loans same day are a safe option. Remember, lending networks are fully transparent, operating as intermediaries and not direct lenders or brokers. However, all earn a commission based on referring loan products and services. Thus, matching bad credit borrowers with reputable and legit bad credit direct lenders is in their best interest.

Can you get a loan the same day you apply?

Yes, getting same day loans you apply is possible with cash advance apps like Earnin, Dave, and Brigit. As mentioned, they offer 0% interest on paycheck advances of up to $100 a day or $750 per pay period, along with plenty of extras, including credit builder tools, automatic budgeting, identity theft protection, and low balance alerts to prevent overdrafts.

Sources

https://www.elitepersonalfinance.com/best-payday-loans-alternatives/

https://www.timesunion.com/marketplace/article/best-instant-cash-advance-loans-for-bad-credit-18087189.php

https://www.nerdwallet.com/best/loans/personal-loans/best-bad-credit-loans

https://www.bankrate.com/loans/personal-loans/bad-credit-loans/

https://www.cnbc.com/select/best-personal-loans-for-bad-credit/

Conclusion

With predatory loan types such as payday, auto title, and pawnshop loans charging 300% of 400% APRs, it’s refreshing to know that online marketplaces like LifeLoans and FundsJoy have our back, offering same day loans with sub-35.99% APRs, flexible repayment terms, and acceptable fee structures that won’t put you in a vicious cycle of debt.

Read the full article here