skynesher/E+ via Getty Images

Floor & Decor (NYSE:FND) is one of the highest quality consumer discretionary companies you could find.

There are three reasons:

1. FND has a clear and actionable expansion plan to acquire market share.

2. FND has its own business niche.

3. FND demonstrated resilience in the current challenging economic backdrop.

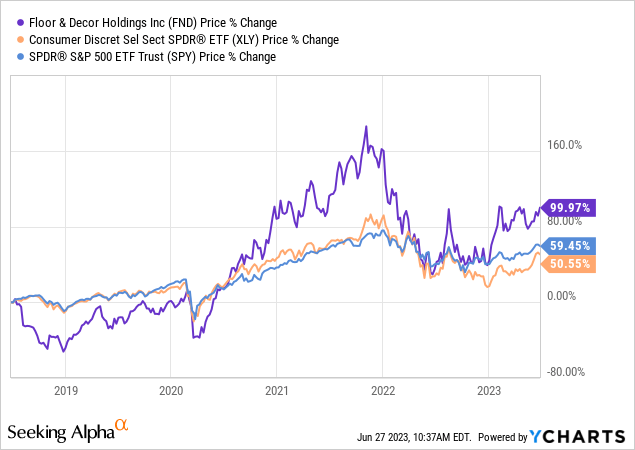

In my previous article, I explained why Consumer Discretionary Select Sector SPDR® Fund ETF (XLY) is not a great pick for the rest of 2023. Selecting quality individual companies, like Floor & Decor, shall give you an edge to achieve better return consistently.

It is not surprising that the return from Floor & Decor doubled XLY over the past 5 years.

Just to be clear. I am not a fan of “buy and hold forever” because the quality of a company may vary as time goes by.

But for now, Floor & Decor is clearly one of a kind.

A Clear and Actionable Expansion plan

Floor & Decor is a hard surface flooring retailer and commercial flooring distributor. As of 30 March 2023, the company operates 194 warehouse-format stores across 36 states, which averaged 79,000 square feet.

As early as 2017, Credit Suisse (CS) viewed FND as a rare growth opportunity:

We view FND as a rare growth opportunity, with 20% annual store growth, above average industry growth trends, ample market share potential, far less e-commerce risk than other retail categories, and a superior management team.

I am optimistic about its future prospect as well.

The company laid out a clear expansion plan to grow its business and gain market share. They target new store openings in both new and existing, adjacent and underserved markets, and plan to grow its store count to 500 in the U.S. over the next 8 to 9 years, at a mid to high-teens annual percentage growth rate annually (slowed from 20% target previously).

The company executed its growth plan excellently. Below tabled the number of warehouse-format store over the past few years.

|

Year |

Number of Stores (Warehouse-format stores only) |

YoY Growth |

|

2017 |

83 |

– |

|

2018 |

100 |

20.5 |

|

2019 |

120 |

20 |

|

2020 |

133 |

10.8 |

|

2021 |

160 |

20.3 |

|

2022 |

191 |

19.4 |

|

Annual Growth (2017 – 2022) |

18.1% |

|

(Source: Floor and Decor Annual Report, Compiled by Author)

In a fragmented industry, gaining market share is not prohibitively difficult.

As a relatively new company, Floor & Decor succeeded to find a runway to grow its business to challenge two home improvement giants in the U.S. (Home Depot (HD) & Lowe’s (LOW)). The company estimated that it represented 10% of total market share in the hard surface flooring market, up from 8% in 2021.

Quantitatively, the primary driver for Floor & Decor’s success is store count growth. The slowing down of store growth target shall hurt its performance a bit, but in my opinion, it is a smart move.

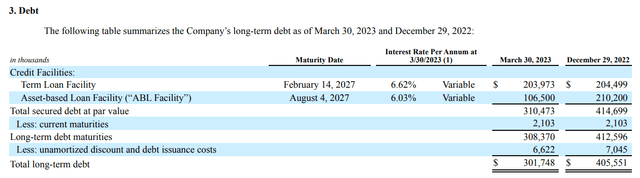

Both the term loan facility and asset-based loan facility are in variable rates, which is disadvantageous in the current high interest rate environment. And more stores mean higher capital expenditure. According to FND’s 2022 Annual Report, each new warehouse-format store requires an investment of around $14.1 million to $16.4 million.

Floor and Decor

A 1.0% increase in the effective interest rate for these debt instruments would cause an increase in interest expense of approximately $3.1 million over the next twelve months. Thankfully, the amount of long-term debt has been cut by 25%, and most of them are payable in 2027.

Finding a Business Niche

Floor & Decor is a specialist in the hard surface flooring industry.

And that is essential for the company to compete with the home improvement giants and other players in the industry. It is almost impossible to challenge Home Depot and Lowe’s with breadth, as both giants have over 4,000 stores across the U.S. combined.

So, it has to be the depth that gives Floor & Decor an edge in the industry.

Specialty retailers like FND provide a comprehensive range of products and a higher number of stock-keeping units (“SKU”). On average, they offered approximately 4,400 SKUs in each store, which is a far greater in-stock offering than any other flooring retailer. Their competitor, LL Flooring (LL), only provided around 500 SKUs in-store.

This business niche attracts professionals to shop in their warehouse-format shops.

Pro Customers sales as a percentage of total sales are up from the low 30s to 42.1% over the past two years. In the latest financial quarter, the Pro comparable store sales increased by 6.9% and transactions by 0.7% on a year-over-year basis. This is an encouraging result given the challenging economic backdrop.

Floor & Decor also held educational workshops for Pro customers to attract new customers, strengthen their stickiness and increase their spending on FND.

The shifting focus to Pro Customers is beneficial to the long-term growth of FND because they are likely to make more frequent store visits, and their professional opinions often affect homeowners’ choices.

Floor & Decor is Resilient

In the latest financial quarter, Home Depot (HD) recorded a 4.5% decline in comparable sales, while Lowe’s (LOW) also dropped 4.3%. Meanwhile, LL Flooring recorded a loss of $0.31, and comparable store sales plummeted 15.4%.

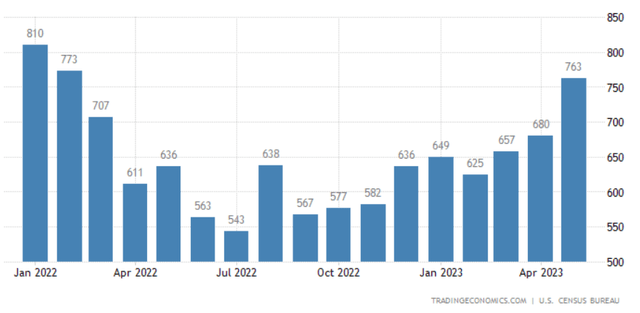

The major culprit is the falling home sales, which have been on a declining trend since February 2022. Existing home sales were cut by about one-third.

Among the home improvement retailers, Floor & Decor was the least impacted. Comparable store sales declined by 3.3% from the same period last year. Floor & Decor’s revenue rose 6.8% to $1.12 billion, and diluted EPS was flat at $0.66 in FQ1 of 2023.

I concur entirely with Tom Taylor, the CEO of Floor & Decor:

We take pride in these earnings results as we believe they demonstrate the continued strong execution of our key long-term growth strategies and our remarkable agility and adapting to significant year-over-year declines in existing home sales amidst the broader macroeconomic challenges we continue to face in 2023.

The result proved its managerial strength. Let’s not forget that Tom Taylor had 23 years of experience at Home Depot and assisted in expanding the store base from 15 stores to over 2,000 stores.

Valuation (Rating Downgrade)

I was the only contributor who rated Floor & Decor a “Strong Buy” in the first half of 2023. The stock was up over 40% since my previous coverage.

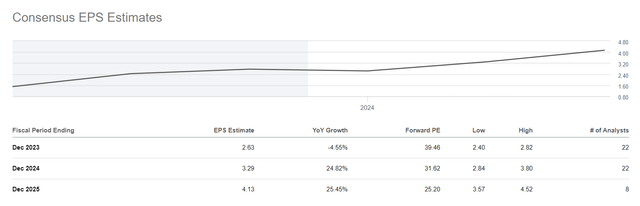

At the time of writing, the stock traded at $103.96, standing within my previously promulgated fair value between $96.2 to $107.5. It has a forward PE ratio of 39.46, which is 6% lower than its 5-year average. The above estimate is based on an anticipation of a 4.5% decline in diluted earnings in 2023 as the housing market continues to struggle.

According to the University of Michigan, Survey Research Center, most respondents thought it was not a good time to purchase a house due to high prices and high interest rate environment.

But, new home sales are rebounding in recent months, and the Street also opines the interest rate hike cycle is ending. The diagram below shows the U.S. new home sales since 2022.

Trading Economics, U.S. Census Bureau

As the Census Bureau explains, new home sales usually lead existing home sales regarding changes in the residential sales market by a month or two. So, there are chances that the worse time has passed, and existing home sales would also pick up gradually.

This well-managed company shall offer you a compounded 25% growth in earnings over the next couple of years. Short-term turbulence shall not impede the excellent growth potential that the company possesses.

And Warren Buffett still holds his 4.5% stake in the company firmly.

Seeking Alpha

But it is worth noting that house remodelling activities usually lag behind home sale activities due to lengthy preparation works, such as invitation of contractors and design planning. Also, laying hard surface flooring is involved in a later stage of a renovation project.

But I downgraded Floor & Decor to “Buy” because even if the housing market revives in the second half of 2023, I am not optimistic that Floor & Decor could overturn the sluggish expectation in 2023. And it is fairly valued right now.

Speaking of value, I found Capri Holdings (CPRI) is in deep value right now. I will explain more in my next article. Stay tuned.

Please feel free to leave a comment below to share your view. Thanks for reading.

Read the full article here