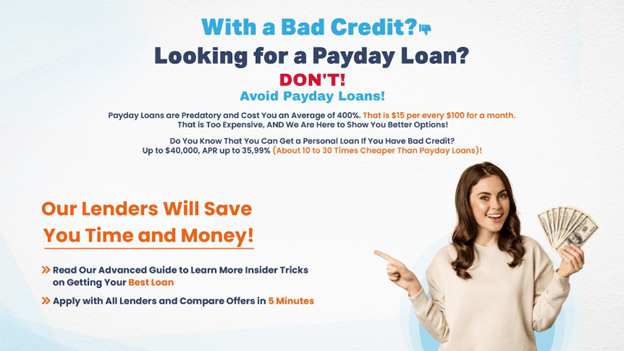

Many people online routinely type in the phrase “where can I find the best $255 payday loans online same day approval no credit check” or other variations into Google. However, uninformed borrowers can make a mistake by signing a loan agreement from a predatory lending company offering sky-high interest rates with 400%+ APRs and inflexible terms. Don’t worry. Our lenders are here to help. They offer personal loans for bad credit. Now you can get up to $40,000, on APR up to 35,99%. Apply with all lenders below and compare offers in minutes.

Best $255 Payday Loans Online Same Day No Credit Check from Direct Lenders

|

Lender |

Rating |

Loan Amount |

APR |

Min. Credit Score |

Best For: |

|

MoneyMutual

|

4.9/5.0 |

$200 — $5,000 |

Up to 35.99% |

0 |

Overall |

|

VivaLoan

|

4.8/5.0

|

$100 — $15,000 |

Up to 35.99% |

0 |

Same Day Online Payday Loans |

|

MarketLoan

|

4.8/5.0 |

$100 — $40,000 |

Up to 35.99% |

0 |

Poor to Fair Credit |

|

ZippyLoan

|

4.6/5.0

|

$100 — $15,000 |

Up to 35.99% |

0 |

No Credit Check Loans |

|

LifeLoan

|

4.5/5.0 |

$100 — $40,000 |

Up to 35.99% |

0 |

Bad Credit Direct Lenders |

Below we will review these lenders and give you detailed guide on how to find the best loan. But before that, we wanted to show you one quick video. There you can find all about bad credit loans at once. Check it now.

If you’re looking for the best places to find and apply for a same day, online $255 payday loan, know that it is possible. Many reputable online lenders are ready to offer you a cheaper loan, even if you have bad credit.

Keep reading our guide to learn more about five highly recommended online marketplaces offering same-day approval, no credit check, sub 35.99% APRs, and generous borrowing limits of up to $40,000 — a masterful alternative to traditional payday loans.

MoneyMutual

|

|

MoneyMutual

Amount: $200 to $5,000

APR: Up to 35.99%

Min. Credit Score: 0

Approval: 5 Minutes

Rating: 4.9/5.0

|

|

|

With more than 2 million customers served to date with stellar reviews, MoneyMutual is one of our preferred no credit check online payday loan providers.

Unlike direct lenders, MoneyMutual operates as an intermediary, connecting borrowers with an expansive network of direct lenders offering anywhere from $200 to $5,000 at favorable APRs of up to 35.99%. Furthermore, its application process is straightforward and user-friendly, taking no more than 10 minutes to complete.

Another benefit to using MoneyMutual is its helpful resource guides with titles like “Cash Advances Explained” and “Bad Credit Loan Guide,” not offered by competing lending networks like 100Lenders and VivaLoans.

We highly recommend MoneyMutual for all types of loans, including bad credit personal loans, instant online cash advances, and alternative online payday loans with same-day deposits and no credit checks from direct lenders that you can trust.

How to Apply: To apply for a MoneyMutual loan, visit the homepage and click the bright orange “Get Started” button. From there, you’ll be asked what state you live in before being asked to provide personal information such as your desired loan amount, employment, contact, and bank account information. Be sure to answer all questions truthfully before reviewing all terms and conditions, submitting the application, and receiving multiple loan offers.

Eligibility:

- Must be at least 18 years old

- Possess a valid government-issued photo ID

- Have a consistent source of income (minimum $800 monthly)

- Favorable Debt-to-income ratio (DTI) and payment-to-income ratio (PTI)

- Hold an active checking or savings account

- Complete the application process through the MoneyMutual website

Highlights:

- Loans of up to $5,000 at sub-35.99% APRs

- Vast network of participating bad credit lenders

- Easy and convenient online application

- 24/7 online platform

- Receive funds as quickly as the next business day

Fees:

- No prepayment or origination penalties

- Late/insufficient funds fees depend on the lender

Pros:

- Loan offers from $200 to $5,000

- APRs from 15% to 35.99%

- Flexible repayment terms from a few weeks to a few months

- Multiple payment methods (e.g., automatic withdrawals and online payments through secure portals)

- All credit types accepted

- Simple and convenient 5-minute online application

- Excellent resource guides with helpful information

Cons:

- Limited loan amounts of up to $5,000

- Higher interest rates compared to traditional loans

- Not all third-party lenders are equally transparent with rates and terms

Terms: MoneyMutual offers a variety of loan products to consumers, including bad credit installment loans, high-risk personal loans, instant online cash advances, and personal loans for bad credit. These loans range in amount from $200 to $5,000 with Annual Percentage Rates (APRs) of up to 35.99%. Repayment terms can extend up to 60 months. As MoneyMutual operates as an online marketplace rather than a direct lender, the specific fees associated with each loan, such as origination fees, prepayment fees, late payment fees, insufficient funds fees, and rollover/extension fees, are determined by the participating direct lenders.

For a better understanding of the potential interest charges (APRs) and fees applicable to your loan, let’s consider an example. Suppose you were to borrow $3,600 with a 22% APR, on a 2-year repayment term, and without any finance charges. In this scenario, your total payment would amount to $4,482.27, with estimated monthly payments of $186.76. Over the course of the loan, you would incur $882.27 in total interest charges.

Be sure to carefully review the terms and conditions provided by each direct lender through MoneyMutual’s platform to ensure you understand all associated costs and obligations before signing on the dotted line.

VivaLoan

|

|

VivaLoan

Amount: $100 — $15,000

APR: Up to 35.99%

Min. Credit Score: 0

Approval: 5 Minutes

Rating: 4.8/5.0

|

|

|

If you’re looking for reliable emergency cash, VivaLoan could offer your next funding opportunity.

To start, VivaLoan direct lenders are willing to offer anywhere from $100 to $15,000 with instant same day approval and funding to your bank account by the next business day. In addition, with APRs up to 35.99% and flexible repayment terms, it’s a much better alternative than traditional payday, auto title, and pawnshop loans known for their excessive 300% and 400% APRs.

Another benefit to using VivaLoan is its quick and easy 5-minute loan request form, which also uses 256-bit SSL encryption technology to keep your information safe. Additionally, the site is a member of the Online Lenders Alliance, a trade organization focused on consumer fraud prevention and lending best practices for its members.

We highly recommend VivaLoan for quick cash to cover unexpected expenses or large-scale projects like debt consolidation and home improvement renovations.

How to Apply: To apply for a VivaLoan loan, visit the homepage, navigate to the upper right corner, and hit the “Start Here” button. From there, you will be presented with a two-page form that takes five minutes to complete. Once submitted, expect to be matched with several direct lenders offering you APRs from 15% to 35.99%. Remember that not all will grant your desired loan amount, subject to change based on how well you meet eligibility criteria.

Eligibility:

- Age requirement: 18 years of age or older

- Identification: Government-issued photo ID

- Income of at least $800 a month

- Valid checking or savings account

- Completed application through the VivaLoan website

Highlights:

- Flexible loan amounts from $100 to $15,000

- APRs up to 35.99%

- Simple and convenient application process

- Vast network of participating direct lenders

- All credit types accepted

Fees

- Lenders have different policies regarding origination, prepayment, late payment, and insufficient funds fees

Pros:

- Loans up to $15,000

- Non-predatory rates of up to $35.99% APR

- Flexible repayment terms of up to five years

- Variety of different loan types (e.g., same-day online $255 payday loans, high risk personal loans, instant online cash advances, and bad credit installment loans)

- Transparent and clearly written disclaimers on every web page

Cons:

- No dedicated customer support line

- No in-person consultations with loan officers

- Limited secured, cosigner, and co-borrower loan options

- May receive unsolicited offers from VivaLoan third-party partners

Terms: VivaLoans offers a variety of loan products to consumers, including bad credit installment loans, high-risk personal loans, instant online cash advances, and personal loans for bad credit. These loans go up to $40,000 with Annual Percentage Rates (APRs) of up to 35.99%. Repayment terms can extend up to 60 months. As VivaLoans operates as an online marketplace rather than a direct lender, the specific fees associated with each loan, such as origination fees, prepayment fees, late payment fees, insufficient funds fees, and rollover/extension fees, are determined by the participating direct lenders.

For a better understanding of the potential interest charges (APRs) and fees applicable to your loan, let’s consider an example. Suppose you were to borrow $31,500 with a 24% APR, on a 3-year repayment term, and without any finance charges. In this scenario, your total payment would amount to $44,490.05, with estimated monthly payments of $1,235.83. Over the course of the loan, you would incur $12,990.05 in total interest charges.

Be sure to carefully review the terms and conditions provided by each direct lender through the VivaLoans platform to ensure you understand all associated costs and obligations before signing on the dotted line.

MarketLoans

|

|

MarketLoans

Amount: $100 — $40,000

APR: Up to 35.99%

Min. Credit Score: 0

Approval: 5 Minutes

Rating: 4.8/5.0

|

|

|

Overland Park, Kansas-based MarketLoans promotes its website slogan “a fast and easy way to find a loan” for a reason.

One of those reasons is its expansive network of direct lenders offering generous borrowing limits from $100 to $40,000 at sub 35.99% APRs. Remember, MarketLoans is not a direct lender, but an intermediary connecting borrowers with a network of direct lenders willing to provide competitive loan terms.

Another benefit to using MarketLoan is its quick and easy 2-minute online application form. If you qualify, expect to be matched with several direct lenders before choosing one, followed by reviewing and signing all loan documentation. From there, you should expect funds to be deposited to your checking or savings account by the next business day, assuming you hit the daily 5pm cutoff for approvals.

How to Apply: MarketLoans makes it very easy to apply for a loan. Visit the homepage, go to the upper right corner, and hit the lime green “Start Now” button to start the application process. Once you submit your application, expect instant approval (assuming you meet all eligibility criteria) with a minimum of three competitive loan offers to follow. Be sure to take your time carefully researching each one before signing any loan documentation.

Eligibility:

- 18 years of age or older

- Legal residency in the United States

- Need to earn at least $800 a month in recurring income

- Government-issued photo ID is required for identification purposes

- Active checking or savings account

- Not a Connecticut, New Hampshire, Washington, and Vermont resident

- Completed application through the MarketLoans website

Highlights:

- Loans from $100 to $40,000

- Same day approval and next business day funding

- Easy 2-minute online loan request form

- Hundreds of participating lending partners

- All credit types considered

Fees:

- Specific charges for origination, prepayment, late payments, and insufficient funds vary depending on the lender

Pros:

- Wide loan range from $100 to $40,000

- Respectable APRs up to 35.99%

- No credit check; all credit types can qualify

- Transparent terms and conditions

- Secure online platform with 256-bit encryption

- Soft inquiry upon loan request submission (no impact on credit score)

Cons:

- Potential for higher-than-average interest rates

- Not all loans are guaranteed

- Might receive unsolicited marketing offers from third-party partners

- No secured, cosigner, or co borrower options

- Not licensed to operate in Connecticut, New Hampshire, Washington, and Vermont

Terms: MarketLoans offers a variety of loan products to consumers, including bad credit installment loans, high-risk personal loans, instant online cash advances, and personal loans for bad credit. These loans go up to $40,000 with Annual Percentage Rates (APRs) of up to 35.99%. Repayment terms can extend up to 60 months. As MarketLoans operates as an online marketplace rather than a direct lender, the specific fees associated with each loan, such as origination fees, prepayment fees, late payment fees, insufficient funds fees, and rollover/extension fees, are determined by the participating direct lenders.

For a better understanding of the potential interest charges (APRs) and fees applicable to your loan, let’s consider an example. Suppose you were to borrow $27.400 with a 18% APR, on a 4-year repayment term, and without any finance charges. In this scenario, your total payment would amount to $38,634.00, with estimated monthly payments of $11,234.00. Over the course of the loan, you would incur $804.87 in total interest charges.

Be sure to carefully review the terms and conditions provided by each direct lender through MarketLoans platform to ensure you understand all associated costs and obligations before signing on the dotted line.

ZippyLoan

|

|

ZippyLoan

Amount: $100 to $15,000

APR: Up to 35.99%

Min. Credit Score: 0

Approval: 5 Minutes

Rating: 4.6/5.0

|

|

|

ZippyLoan is an online platform that connects borrowers with a network of lenders offering all types of loans, including bad credit personal loans, same day online payday loans, and high risk personal loans.

When using ZippyLoan, expect participating direct lenders to offer $100 up to $15,000 at APRs between 12% and 35.99%. Remember, these higher-than-average interest rates are due to the increased risk assumed by lenders in disbursing funds to bad credit borrowers. However, ZippyLoan does offer flexible repayment terms (up to 60 months), as well as quick and easy same day approval with funding to a valid checking account as early as the next business day.

One advantage of ZippyLoans over traditional payday, auto title, and pawnshop loans is that some lenders within its network do report on-time payments to credit bureaus. With a payment history accounting for 35% of your FICO score, we appreciate this credit-building exercise, allowing you to put that emergency cash to better use.

In short, ZippyLoan is one of the more well-rounded lending networks we’ve come across, complete with generous borrowing limits, solid APRs, and flexible repayment terms that allow you to customize your payment schedule for manageable monthly payments.

How to Apply: Applying for a loan with ZippyLoan is a breeze. Just visit the homepage, hit the “Get Started” now button in the upper right corner, and start your application. After submitting your application, expect a minimum of three competitive loan offers. Be sure to thoroughly review all terms and conditions outlined in the loan agreement before adding your signature to the mix.

Eligibility:

- Must be 18 years of age or older

- Legal residency in the United States (citizen or green card holder)

- Minimum monthly income of $800

- Active checking/savings account

- Completed ZippyLoan application

- Not a New York, West Virginia, Oregon, or District of Columbia resident

Highlights:

- Loans from $100 to $15,000

- APRs from 12% to 35.99%

- 256-bit SSL encryption technology keeps your information safe

- Quick and easy 5-minute online application

- Visible and well-written disclaimers on all web pages

- Decisions made in real-time with next day funding

- No credit check

Fees:

- Fees such as origination, prepayment, late payment, and insufficient funds vary from lender to lender

Pros:

- Loans from $100 to $15,000

- APRs up to 35.99%

- Secure and confidential online application form

- Fast funding by the next business day

- Vast network of participating direct lenders

- It can be used for all purposes, including medical expenses, debt consolidation, and home renovations

Cons:

- Limited maximum borrowing limit of $15,000

- Higher than average APRs for same day, online payday loans

- No dedicated customer service phone number or email

- Information may be shared with lenders within the Zippyloan.com network

- Not licensed to operate in New York, West Virginia, Oregon, and the District of Columbia

Terms: ZippyLoan offers a variety of loan products to consumers, including bad credit installment loans, high-risk personal loans, instant online cash advances, and personal loans for bad credit. These loans go up to $15,000 with Annual Percentage Rates (APRs) of up to 35.99%. Repayment terms can extend up to 60 months. As ZippyLoan operates as an online marketplace rather than a direct lender, the specific fees associated with each loan, such as origination fees, prepayment fees, late payment fees, insufficient funds fees, and rollover/extension fees, are determined by the participating direct lenders.

For a better understanding of the potential interest charges (APRs) and fees applicable to your loan, let’s consider an example. Suppose you were to borrow $12,900 with a 31% APR, on a 3-year repayment term, and without any finance charges. In this scenario, your total payment would amount to $19,969.73, with estimated monthly payments of $554.71. Over the course of the loan, you would incur $7,069.73 in total interest charges.

Be sure to carefully review the terms and conditions provided by each direct lender through the ZippyLoan platform to ensure you understand all associated costs and obligations before signing on the dotted line.

LifeLoans

|

|

LifeLoans

Amount: $100 to $40,000

APR: Up to 35.99%

Min. Credit Score: 0

Approval: 5 Minutes

Rating: 4.5/5.0

|

|

|

If you’re looking for a reliable source of high-risk personal loans, instant online cash advances, and even $255 same-day online payday loans with no credit check, then LifeLoans is the way to go.

This user-friendly platform offers access to hundreds of participating direct lenders offering borrowing amounts from $100 up to $40,000, helping borrowers address unexpected expenses and large-scale projects all in one. We especially appreciate its competitive annual percentage rates of up to 35.99% with no hidden fees, origination, or prepayment penalties.

Another benefit to using LifeLoans is a secure and confidential loan application with 256-bit encryption, ensuring all of your data has been kept safe. It is also a proud member of the Online Lenders Alliance (OLA), which guides lending institutions on the highest ethical standards of conduct for lending.

In short, LifeLoans is a solid option for a $255 online same-day payday loan with no credit check from reputable direct lenders.

How to Apply: Applying for a loan with LifeLoans.com is so easy, even a child can do it. To get started, visit the website (desktop or mobile), familiarize yourself with its loan options/disclaimers, and click on the “Start Now” button. From there, you will be prompted to complete the online application, providing your details, contact information, employment details, and financial information. Once submitted, expect to be matched with several direct lenders, who may or may not request additional supporting documentation before extending an offer.

Eligibility:

- Must be 18 years of age or older

- S. citizen or permanent resident

- Must have recurring employment income

- Not a Connecticut, New Hampshire, Washington, or Vermont resident

- Application through the LifeLoans portal

Highlights:

- Loans up to $40,000

- Fair and affordable rates (up to 35.99% APRs)

- No credit checks and same day approval

- 256-bit encryption data security for online forms

- Excellent source of $255 payday loans online same day

Fees:

- No origination fees and no prepayment penalties

- Late/insufficient funds fees vary by lender

Pros:

- Wide range of loan amounts up to $40,000

- Annual Percentage Rates (APRs) up to 35.99%

- Good for all credit types

- Convenient 5-minute online application

- Focus on data security and lending best practices with 256-bit encryption and OLA membership

Cons:

- Limited secured loan options

- No guarantee of loan qualification

- Lender variability (not all are equally transparent)

- Information sharing with third-party aggregators

- Not available in Connecticut, New Hampshire, Washington, and Vermont

Terms: LifeLoans offers a variety of loan products to consumers, including bad credit installment loans, high-risk personal loans, instant online cash advances, and personal loans for bad credit. These loans go up to $40,000 with Annual Percentage Rates (APRs) of up to 35.99%. Repayment terms can extend up to 60 months. As LifeLoans operates as an online marketplace rather than a direct lender, the specific fees associated with each loan, such as origination fees, prepayment fees, late payment fees, insufficient funds fees, and rollover/extension fees, are determined by the participating direct lenders.

For a better understanding of the potential interest charges (APRs) and fees applicable to your loan, let’s consider an example. Suppose you were to borrow $9,000 with a 21% APR, on a 3-year repayment term, and without any finance charges. In this scenario, your total payment would amount to $12,206.72, with estimated monthly payments of $339.08. Over the course of the loan, you would incur $3,206.72 in total interest charges.

Be sure to carefully review the terms and conditions provided by each direct lender through the LifeLoans platform to ensure you understand all associated costs and obligations before signing on the dotted line.

What Are Payday Loans Online?

Online payday loans are one of the more popular sources of emergency cash. It’s an excellent source of funds to pay for unexpected expenses like overdue hospital bills or unpaid electric or water bills, effectively bridging the gap between paychecks.

For starters, traditional payday loan borrowing amounts go up to $1,000, repaid on the borrower’s next payday (within two to four weeks). In addition, unlike traditional cash advance places that accept post-dated checks or withdrawal authorization to retrieve funds on your next payday, online payday loan companies accept a single installment (unless you request a loan extension).

In turn, one of the biggest draws of online payday loans is their loose eligibility requirements. All you need to be is 18 or older with a government-issued photo ID, minimum monthly income (generally $800 a month), and a valid checking or savings account to disburse loan proceeds.

It’s an excellent deal for those struggling to qualify for traditional loans from banks and credit unions!

Benefits to online payday loans include quick accessibility, 100% online applications (no in-person visits to a sketchy cash advance place!), same day approval and funding to your account by the next business day.

Continue reading our guide below to learn more about the best $255 same-day online payday loan opportunities, including how they work, the differences between payday loans and bad credit installment loans, and ways to boost your credit score to achieve the lowest interest rates possible.

Do Payday Loans Offer Same-Day Funding?

One of the greatest benefits of traditional payday loans is their ability to provide same day funding. Quick approval and fast processing times disburse funds within minutes, as long as you submit your loan request by a daily cutoff).

However, payday loans are debt traps thanks to their outrageous 400% APRs, inflexible repayment terms (two to four weeks), and the constant threat of bank-issued overdraft/insufficient funds and repeated extension fees of up to $60 for an extra two weeks to repay back the full loan.

We highly recommend alternative same day online payment loans from reputable online marketplaces like 100Lenders, MarketLoans, VivaLoans, and LifeLoans, which offer more competitive rates and terms. Think 15% to 35.99% APRs, repayment terms of up to 60 months, no prepayment penalties, and no origination fees that force borrowers to cover lenders’ staffing, overhead and administrative costs — not our business!

How Do Payday Loans Online Same Day Work?

Online same day payday loans are an excellent alternative to traditional payday loans from your local cash advance place. They offer anywhere from $100 up to $40,000 at favorable sub 35.99% APRs and repayment terms for as long as 60 months.

All that’s needed is to visit a lending network with hundreds of participating direct lenders and complete a streamlined approval process. Instead of a minimum required credit score, direct lenders from reputable online marketplaces like VivaLoan and MarketLoan rely on a borrower’s age, income, debt-to-income ratio, and similar qualification criteria.

Once a loan request form is submitted, expect to be matched with at least three direct lenders offering their interest rates, repayment schedules, and penalty structure (origination, prepayment late, and insufficient funds fees). Review all agreement terms and consult with third-party review sites for extra assurance before signing the dotted line.

Once a borrower agrees to same day online payday loan terms, expect to transfer funds as early as the next business day. In rare cases, funds can even be issued on the same day. Once you receive funds, the countdown starts for repaying the loan in full, including any applicable interest and finance charges like late and insufficient funds fees.

Typically, online payday loans can be short term or longer-term installment loans, where lenders automatically withdraw a minimum or entire balance from the borrower’s bank account. This process differs from traditional cash advance places that accept post-dated checks or get authorization for automatic electronic withdrawals from your bank account without safeguards to prevent overdrafts and insufficient funds fees.

We recommend thoroughly researching all loan offers before applying for any same day online payday loan. Be sure to review the fine print and check for physical addresses, licensing in the appropriate jurisdiction, representative loan examples, information-sharing policies, and consequences of non-payment.

By carefully conducting research, you’ll be on your way to securing a competitive same day online payday loan that sends traditional payday, auto title, and pawnshop loans to the wayside.

How to Find the Best $255 Payday Loans Online Same Day Online

To find the best same-day, $255 online payday loans, follow the strategies below:

Assessing Your Financial Needs. The first step is to understand your current financial situation. For example, are you looking for a quick $255 to pay a past-due utility bill? What about a larger $3,500 bad credit loan to pay an outstanding balance escalated to collections? Understand your desired loan amount, the purpose of the loan, and the repayment term you are comfortable with before proceeding.

Understand Your Credit Profile. The next step is to understand your credit profile. What is your current credit score? If you need to know your current credit score, visit annualcreditreport.com and pull a credit report from Experian, Equifax, and Transunion, the three major credit reporting agencies in the United States.

If your credit score is in the 300 to 580 range, expect APRs anywhere from 31% to 35% (although 15% and up are not uncommon). Higher credit scores than the 600 to 850 range will qualify you for the lowest interest rates possible.

Researching Lenders and Loan Options. Once you have assessed your financial needs and understood your credit profile, it’s time to compare lenders and loan options.

Start by researching a mix of bad credit personal loans, alternative payday loans, and instant online cash advance companies by submitting loan request forms through MoneyMutual, 100Lenders, and other reputable lending networks. Then, compare interest rates, fees, and repayment terms, calculating the total cost of borrowing using an APR calculator.

One of our favorite APR calculators is Experian’s, which can be found here. This tool lets you input your desired loan amount, finance charges (if applicable), interest rate, and repayment term (in years).

Hitting the “Calculate” button will crunch the hypothetical loan’s estimated monthly payment, number of payments, payoff date, total interest rate, and any total cost of borrowing (principal + interest + finance charges). It even breaks all numbers above by month for a better picture of balances over time.

By following the above suggestions chronologically, you’ll find the best no credit check, $255 alternative payday loan in no time.

Can I Find $255 Small Quick Loans That Are No Credit Check?

Although a $255 loan may appear small, no credit checks for this amount are possible. Three of the most popular types of loans offering this amount are payday, auto title, and pawnshop companies. However, we highly advise against them due to predatory rates (300% and 400% APRs), inflexible repayment terms, and excessive finance charges. That’s not even including unintended bank fees, with repeated automated withdrawals having the potential to pepper you with $39 bank overdraft fees.

Instead, we recommend alternative lending options like same-day online no credit check loans from reputable sites like MoneyMutual and 100Lenders.

You may also use a 0% interest cash advance apps like Earnin, Brigit, and Dave, which offer advances of up to $100 per day or $750 per pay period, depending on your income, incoming cash flow, and other criteria cash advance apps used to determine eligibility. However, they are strictly meant to cover paycheck gaps with smaller dollar loans. For higher dollar loans, rely on high risk personal loans, bad credit installment loans, and same day online payday loans.

Do $255 Payday Loans Come From Direct or Non-Direct Lenders? Which Is Better?

Direct lenders or non-direct lenders can offer same-day $255 online payday loans.

In short, direct and non-direct lenders differ regarding relationship/accessibility and the loan options they offer.

Unlike direct lenders that provide loans directly to borrowers (managing the entire application, approval, and repayment process), non-direct lenders are intermediaries between borrowers and lenders. Instead of funding loans, they offer access to hundreds of participating direct lenders offering several loan options, including high-risk personal loans, incident online cash advances, and even $255 same-day online payday loans.

Another difference between direct and non-direct lenders is loan options and flexibility. Direct lenders manage their own loan products and underwriting policies, good for customized loan options with the ability to negotiate borrowing amounts, repayment terms, and interest/finance charges.

In turn, direct lenders offer limited loan options from different sources. Therefore, it’s an excellent way to compare multiple loan offers from direct lenders. In the case of MoneyMutual, VivaLoans, and other recommended lending networks, most unsecured loans do not require collateral.

In short, direct and non-direct lenders can issue $255 payday loans online on the same day. However, one directly provides loans to borrowers, whereas the other facilitates the connection between borrowers and lenders.

Do Small $255 Payday Loans Offer Guaranteed Approval?

As is the case with all loans, there’s no such thing as guaranteed approval, whether it’s a small $255 payday loan or a higher-dollar $10,000 bad credit personal loan.

Remember, small $255 payday loans have much more lax eligibility requirements than traditional loans from banks and credit unions. All you need to do is show a recurring income (e.g. via paystubs or electronic timesheets), as well as employment status with a valid checking or savings account to disburse funds. Then, you can issue post-dated checks or authorized automatic withdrawals on your next payday.

However, it is essential to know that reputable lending networks like MoneyMutual and VivaLoan offer alternative options for those seeking $255 same day online payday loans with self-initiated repayment rather than a forced withdrawal like your local cash advance place advertising “guaranteed rates,” requesting upfront fees, and other predatory lending practices.

Small Payday Loans Vs. Installment Personal Loans

There are fundamental differences in the case of small payday loans versus installment personal loans.

Loan Amount/Borrowing Limits. Payday loans are smaller dollar loans of no more than $1,000 (depending on the state’s usury laws regarding max borrowing amounts). In turn, some personal loans offer higher amounts of up to $100,000 (SoFi). All of our recommended lending networks like MoneyMutual, VivaLoan, and NextDayPersonaLoan provide bad credit loans up to $5,000, $15,000, and $40,000 respectively.

Repayment Terms. Another key difference between payday loans and installment personal loans is with repayment terms. Traditional payday loans from cash advance stores typically offer two to four-week repayment terms, repaid on your next payday.

Personal loans offer longer repayment terms of up to 72 months, repaid in fixed monthly installments.

Eligibility Requirements. Eligibility criteria for traditional payday loans are much less restrictive, requiring no credit checks with a minimum income. Installment personal loans may or may not run credit checks with harsh eligibility criteria factoring in income, debt-to-income ratio (40% or less), and employment history.

In short, the key differences between small payday loans and installment personal loans are loan amounts/borrowing limits, repayment terms, and eligibility requirements.

Are All Bad Credit Loans No Credit Check?

In short, not all bad credit loans are no credit check loans. Instead of requiring a minimum credit score, other factors may be considered, such as income, debt-to-income ratio, checking account, and employment history.

With no credit check secured loans (e.g., auto title or pawn shop loans), you must also put up collateral such as a vehicle or money market account. However, we highly advise against these loans as they generally come with predatory interest rates (upwards of 300% of 400% APR), excessive fees, and inflexible repayment terms of no more than two to four weeks. Additionally, there are too many predatory lending practices to count.

With all bad credit loan companies, we highly encourage you to ask lenders about any minimum required credit score, reviewing loan terms and conditions with a magnifying glass. That way, you can find the best bad credit loan for your financial needs.

Tips on Increasing Your Bad Credit Score

We recommend boosting your credit score before your next loan application to qualify for the lowest interest rates. For example, increasing your credit score by 70 points or more could easily mean the difference between a 22% APR and a 29% APR.

Here are four surefire strategies for increasing a bad credit score:

Diversify Credit Mix. Credit accounts for 10% of your FICO score. Diversify your credit mix across different lines, such as revolving accounts (e.g., retail and gas station cards) and installment accounts like mortgages and student loans. This shows lenders know you can manage different types of credit responsibly.

Limit the Number of New Credit Applications. Try to keep the number of new credit applications you submit within a short time window. Multiple inquiries over a 90-day to six months. It can negatively impact your credit score.

Dispute Credit Reporting Errors. With one in five Americans experiencing an error on their credit reports, you must pull it regularly, examining it for errors. Check for incorrect balances, false late payment dates, accounts marked as open that should be closed, and similar errors. Remember to check for unfamiliar accounts or unauthorized transactions, a telltale sign of identity theft.

Maintain Good Payment History. Arguably our number one recommendation is making timely payments every single time. With a payment history accounting for 35% of your FICO score, be sure to pay all your lines of credit on time, including utilities and rent.

With all of the above strategies, expect the biggest boost to your credit score after successfully filing a dispute (usually taking up to 45 business days to settle, depending on the creditor and/or credit bureau).

Excellent Alternatives to No Credit Check Loans For Bad Credit Borrowers

Sometimes, people decide that higher-than-average APRs of up to 35.99% on a bad credit loan may be a tad high. The concerns are valid, especially since repayment terms range from four to seven years.

Thankfully there is no shortage of alternatives to consider:

0% Interest Cash Advance Apps. Over the past several years, 0% interest cash advance apps have provided borrowers with quick access to funds to cover paycheck gaps. It’s much faster and more convenient than traditional lending options.

Three of today’s most popular 0% interest cash advance apps include Earnin, Brigit, and Dave. They are good for cash advances of up to $100 per day or $750 per pay with additional benefits, including cash back rewards programs, identity theft protection, overdraft protection, and insights into user spending habits for personalized recommendations on improving finances.

Out of these three cash advance apps, our nod goes to Earnin. It offers the highest borrowing limits versus Brigit and Dave, which offer up to $500. Another benefit is that it accepts voluntary tips of up to $14, which differs from the latter, with monthly membership fees of $1 and $9.99, respectively.

Keep in mind that these cash advance apps are only intended to cover paycheck gaps, not large-scale purchases.

Payday Alternative Loans (PALs). Offered by qualifying credit unions, PALs provide much more favorable terms and lower interest rates than traditional payday, auto title, and pawnshop loans. PALS typically go from $200 to $2,000 worth of repayment terms anywhere from one to 12 months with capped 28% APRs, making them a much more viable borrowing option.

Plus, rather than maximize profits, credit unions offering PALs focus on member retention with additional resources such as financial education tools and online calculators. They are really invested in your success.

To qualify for a PAL, you must be a member of the credit union with an opened checking or savings account, proof of income, and a basic credit check. Don’t worry, you don’t need a 750 credit score to qualify. In addition, expect no prepayment fees but application fees of up to $20.

Four highly recommended credit unions include Alliant Credit Union, Pentagon Federal Credit Union (PenFed), First Tech Federal Credit Union, and Navy Federal Credit Union.

Credit Card Cash Advances. One another source of immediate cash is credit card cash advances. Credit card cash advances allow you to withdraw money from an ATM at a bank against your credit limit and add it to your credit card balance.

However, it is essential to note that credit card cash advances come at higher interest rates than regular credit card purchases. For example, the Discover card offers variable APRs in the 28% range with interest accruing from Day 1 (no grace period). However, benefits include more than 500,000 participating ATMs, online direct deposit within one to three days, and even cash access checks where you can request reviews online.

Another important thing to note with credit card cash advances is that it will affect your credit utilization ratio, which is your total credit limit versus the amount of available credit you use. We highly recommend keeping your credit utilization ratio app or under 40% with preferences in the single digits (e.g., between 7% and 10%)

If you plan on taking out credit card cash advances, do so to repay it within a week to minimize interest charges.

Borrowing from Family and Friends. One often overlooked source of funding is borrowing from family and friends. While payday loans offer quick access to cash, 400% APRs and inflexible repayment terms create a vicious cycle of debt.

By borrowing from family and friends, expect greater trust and flexibility between parties with lower or no interest rates, flexible repayment terms, and customized repayment plans. Additionally, your loved ones are more likely to have your best interest in mind, offering emotional support that no traditional lending institution can offer.

All in all, 0% cash advance apps, alternative payday loans, borrowing from family and friends, and credit card cash advances are four alternatives to $255 same-day online payday loans, each with advantages and disadvantages.

A Review Of Three Cash Advance Apps And Why They May Be a Preferable Option

If you want a viable alternative to $255 same-day online payday loans, 0% interest cash advance apps like Earnin, Dave, and Brigit may be excellent options. All free apps allow you to access some of your earnings before your next payday without interest or traditional fees like origination or prepayment penalties.

Let’s dive deep into five highly recommended cash advance apps.

Earnin. Arguably the most popular cash advance app on the market today, Earnin offers cash advances of up to $100 per day or $750 per pay. All this is offered for a voluntary tip of up to $14. Benefits of using Earnin include Early Access to earned wages and its innovative Balance Shield feature, which helps you avoid overdraft fees by funneling additional funds into your account when your balance reaches closer to $0.

However, it is essential to know that eligibility may be constrained, as it is best used for bad credit borrowers that earn regular paychecks via direct deposit.

Brigit. Brigit is an excellent alternative to Earnin, offering cash advances of up to $250 at 0% interest with no credit check. Unlike Earnin, it charges a monthly $9.99 membership fee. However, it offers extra benefits like up to $1 million dollars in identity theft protection, credit building tools, and a finance helper that allows you to analyze your spending habits and identify budgeting opportunities.

Another thing to consider with Brigit is its Stellar reviews, with over 250,000 ratings averaging 4.5 stars or higher on the App Store and Google Play stores. With over four million users, Brigit is easily a top three cash advance app.

Dave. Los Angeles-based Dave is another highly recommended cash advance app. Calling itself “your ultimate financial friend,” it offers cash advances of up to $500 with a proprietary reward program that allows you to get paid up to two days early. Extra features include up to 15% cash back on select purchases using its branded debit card and a “Side Hustle” job listings feature that allows you to find work.

Like Brigit, Dave also enjoys stellar ratings with more than 575,000 positive App Store reviews and 426,000 Google Play reviews (as of this writing). It also operates on a monthly membership model ($1 monthly).

As for same day funding fees, they are also reasonable. For example, Dave charges anywhere from $0.99 to $6.99 depending on the amount advanced. There is no fee for standard transfers.

In addition to all the benefits above, expect bank-level security and backing by the FDIC (e.g., up to $250,000 with Dave). We also appreciate all three cash advance apps’ customer service. For example, Dave offers a dedicated Help Center with answers to the most frequently asked questions on its spending account, debit card program, and more.

These five cash advance apps work as a temporary stopgap measure intended to cover paycheck apps, not larger dollar expenses like home renovations or debt consolidation.

Our Lending Network Selection Process

Compiling lending networks offering the best $255 same day online payday loans with no credit check took a lot of work. However, out of the 30+ lending networks we reviewed, many are recommendable in all of the following criteria: APR/interest rates, fee, ease of use, transparency, and repayment terms.

Let’s dive deeper into how we chose MoneyMutual, VivaLoan, MarketLoan, ZIppyLoan, and LifeLoan, with MoneyMutual winning Best Overall.

Interest Rates: Assessing the Cost of Borrowing

For starters, ensure competitive interest rates no greater than 35.99% APR, representing the maximum threshold before entering predatory rate territory. Any reputable online lending network will offer at least three direct loan offers with sub 35.99% APRs and fair repayment terms.

Fees: Evaluating Additional Costs

Most of our recommended online marketplaces charge no origination or prepayment penalties. However, unlike interest charges, origination fees are non-refundable, with no reimbursement, even if paying off the loan early or refinancing towards the lower interest rate.

Additionally, they only add to the overall cost of borrowing, paying for staff, overhead and administrative fees when you don’t have to (interest charges should cover that!). Remember, the higher the origination fee, the higher the APR.

Except for FundsJoy and Upstart (which feature direct lenders charging origination fees of up to 5% and 8%, respectively), all of our other recommended online marketplaces do not charge them.

At best, you should only be focused on paying late and insufficient funds fees, which is a standard cost of doing business with banking institutions.

Ease of Use: User-Friendly Platforms

All of our recommended online marketplaces have an intuitive and streamlined application process. They usually comprise two-page forms requesting your contact and depositing instructions for funds disbursement by the next business day.

Remember concise and easy-to-read forms with helpful progress bars or percentage icons to depict progress.

Transparency: Read The Fine Print

Another essential thing to consider with the best same day online payday loan companies is their fine print. Reputable online marketplaces like MoneyMutual and ZippyLoans have well-written disclaimers on every web page, such as their status as an intermediary, information-sharing policies with third-party partners, states of operation, and other much-needed disclosures. In addition, they all explicitly state that these lending marketplaces are not involved in the loan approval or lender decision-making process.

Repayment Terms: Flexible and Manageable Options

We are big fans of lending marketplaces that offer flexible repayment terms. By allowing borrowers to choose a repayment plan, it can help them to manage monthly payments better. Luckily, recommended marketplaces offer repayment terms anywhere from six months upwards of 60 months (even 72 months in some cases).

Be Weary of Scam Tactics with Some Local Cash Advance Places and Online Payday Loan Companies

Unfortunately, the payday loan industry is rife with scams. One of the biggest culprits is local cash advance places and deceptive online companies that target vulnerable populations with promises of guaranteed rates and request upfront fees.

Here are five signs to watch out for with your local/online payday loan cash advance place:

Advance Fee Scams. One of the biggest signs of a payday loan scam is a request for upfront fees before releasing funds. Scammers often do an excellent job convincing unsuspecting borrowers that it’s meant for processing, administrative, insurance, or similar fees. Be mindful that legitimate lenders will never ask for upfront fees.

Identity Theft. Sometimes, scammers are more interested in collecting your personal and sensitive information through payday loan applications. Sometimes this involves creating fake websites to trick people into sharing personal details like social security numbers and bank account information. This allows scammers to steal your identity and open lines of credit to make unauthorized purchases. Ensure you’re only sharing your personal information with legitimate online lenders.

Robocall Scams. Many payday loan scammers are known to make unsolicited robocalls that promise payday loans without standing terms, such as guaranteed rates or ultra-low interest rates in single-digit percentages. Sometimes these scammers the skies these as limited-time offers. Under no circumstances do legitimate lenders participate in this type of scheme.

Fake Debt Collection. Phantom debt collector scams have become popular over the past decade. With fraud, scammers call unsuspecting individuals and claim to be debt collectors looking to recover unpaid payday loan debt. Sometimes they may use aggressive collections tactics threatening lawsuits or even imprisonment if you do not make payment on time. Often they will even share your personal information with you, which is illegally obtained from data breaches.

By checking for any of the above, you’ll be on your way to best identify payday loan scams from a mile away.

A Word on Payday Loan Laws

Over the past few decades, payday loans have achieved a well-deserved reputation for their outrageous high-interest rates and predatory collections practices, trapping borrowers in a vicious debt cycle.

As a result, many states have established usury laws protecting the rights of consumers from predatory lending practices. These laws limit the interest rates, repayment terms, and APRs payday lenders offer. For example, in 2003, the state of Alabama enacted the Alabama Deferred Presentment Services Act (Act 2003-359), which limits the maximum loan amount to $500 with a maximum 31-day repayment term and finance charges no greater than 17.5% of the loan amount.

For example, if you take out a $200 Alabama payday loan, the maximum finance charge would be $35. This does not include verification fees (usually no more than $3) and collection costs if you fail to repay the loan.

Given payday loans’ reputation, it is not surprising to know that they are illegal in certain states. For example, payday loans are illegal in Arizona, Arkansas, Colorado, Connecticut, Georgia, Maryland, Massachusetts, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Pennsylvania, South Dakota, Vermont, West Virginia and the District of Columbia.

Unfortunately, usury laws creep up on actual reputable online marketplaces from time to time. For example, Money Mutual is not licensed to operate in New York or Connecticut. However, it does offer favorable rates and terms in states where it can operate. So being unable to operate in two out of 50 states is okay.

In short, it is essential to be mindful of state usury laws, as they are fully intended to protect the rights of consumers and prevent them from entering a vicious debt cycle.

Frequently Asked Questions

Can I use a $255 payday loan online on the same day for any purpose?

Yes, a $255 same-day online payday loan can be used for virtually any purpose. Whether it’s to pay an upcoming bill, unexpected expenses, or serve as a paycheck app, there’s plenty of flexibility. Just be sure to repay the debt by the due date to avoid any finance charges.

What is the repayment period for a $255 payday loan online same day?

For $255, payday loans online or short-term loans can be repaid within a few days up to 60 months. However, they have to come from lending networks like MoneyMutual and 100Lenders. Traditional cash advance places promoting $255 payday loans generally have shorter two to four-week repayment terms, repaid on your next payday.

Can I apply for a $255 payday loan online the same day if I’m unemployed?

If you are unemployed, you’re not eligible for an online $255 same day payday loan. However, you don’t have to be signed up to an employer. You can also qualify with an alternative source of income, like social security payments.

What are some ways I can boost my credit score?

We highly recommend boosting your credit score before any loan application to qualify for lower interest rates. Five surefire strategies to boost your credit score include paying all bills on time (every time!), reducing credit card balances, maintaining a diverse credit mix, avoiding opening multiple new accounts, and regularly checking your credit report for errors.

Remember, boosting your credit score takes time. So do not expect any quick fixes (unless you are disputing a serious credit reporting error, which can increase your credit score by 100 points or more in one shot).

Sources

https://www.elitepersonalfinance.com/best-payday-loans-alternatives/

https://www.timesunion.com/marketplace/article/best-instant-cash-advance-loans-for-bad-credit-18087189.php

https://www.experian.com/blogs/ask-experian/credit-education/improving-credit/improve-credit-score/

https://www.nerdwallet.com/best/loans/personal-loans/best-bad-credit-loans

Conclusion

Thankfully, these five lending networks offer the best $255 same-day online payday loans with no credit checks from direct lenders. They offer much more competitive terms than local cash advance and payday loan places, such as sub 35.99%s, longer repayment terms, no origination/penalties, and non-existent predatory lending practices that will help you feel more confident with your loan. Ultimately, we highly recommend these lending networks in providing you with the fast and easy emergency cash you need

Read the full article here