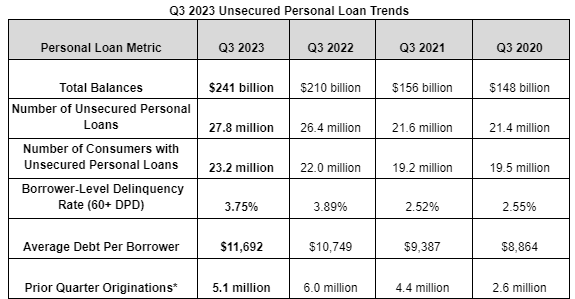

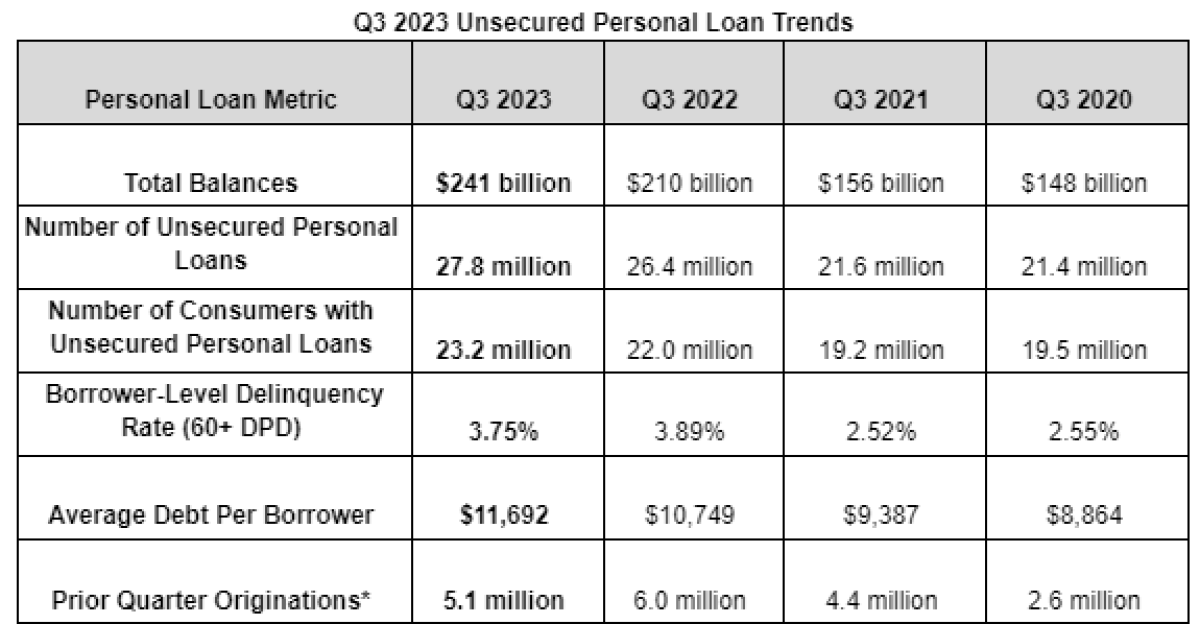

Financially secure Americans are increasingly turning to unsecured personal loans, pushing total balances to an all-time high of $241 billion in the third quarter as retail sales in the U.S. hit nearly $705 billion in September.

The surge, as reported by TransUnion’s latest Credit Industry Insights Report, is spearheaded by super-prime consumers—those with a credit score of 781 and higher—amid a landscape of stubborn inflation that forces them to overcome the rise in prices.

Americans added $9 billion in unsecured loans over the third quarter, TransUnion’s data shows, marking the eighth consecutive month of growth, with super-prime consumers leading the pack at a year-over-year balance growth of 38.6 percent.

ASIF HASSAN/AFP via Getty Images

Increased Use of Personal Loans and What That Means for The Economy

According to Silvia Manent, founder and managing partner of Manent Capital: “The surge in unsecured loans could indicate a proactive approach by these consumers to consolidate debt and secure funds for potential investments.”

However, Charlie Wise, senior vice president of global research and consulting at TransUnion, said that the post-COVID rise of inflation has “left overall prices sharply higher across a wide range of products and services—not just discretionary spend categories, but everyday items that consumers rely on.” This, Wise added, is causing consumers to tap into credit lines.

Unsecured personal loans offer collateral-free financial avenues with predictable repayment terms, appealing to consumers with strong credit histories. In recent years, these types of loans have evolved into strategic financial tools for debt consolidation, credit refinancing, and covering expenses such as home improvements.

The current borrowing behavior contrasts with previous economic cycles. Commonwealth Financial Network chief investment officer Brad McMillan told Newsweek: “Unlike the aftermath of the 2008 financial crisis, where balances were less pronounced among borrowers, personal loan balances saw an uptick in the year following COVID-19 lockdowns.”

With this historical data in mind, the recent upswing in borrowing by the most creditworthy individuals stands out, particularly at a time when loan originations for other credit tiers are generally experiencing a downturn, according to TransUnion’s data. Super prime origination numbers grew by nearly 20 percent over the quarter while originations for lower tiers fell slightly or stayed the same.

What Makes Personal Loans Attractive Now

While super-prime borrowers are traditionally seen as less reliant on borrowing, their increased activity in the personal loan market has noteworthy implications alongside Federal Reserve Bank of New York data issued Tuesday that showed U.S. households added roughly $78 billion in debt over the third quarter, and a retail sales report that highlighted the surprising resilience of consumer spending.

“People tend to like the predictability of installment loans like personal loans and buy now pay later loans,” Matt Shulz, chief credit analyst at Lending Tree, told Newsweek. “People also like that installment loans are finite. They like being able to borrow the money when they need it, but when it is paid off, they want to be done with it.”

“Most personal loans are taken out for purposes of debt consolidation and credit card refinancing,” Manent added.

Increased borrowing presents a dichotomy, where the financially secure added $3.47 billion in personal loans over the quarter, while the American consumer at large continues discretionary spending amid rising prices and economic uncertainty.

TransUnion

“This is something worth watching in the months to come,” Liz Pagel, senior vice president of consumer lending at TransUnion said in a statement. She added there is a growing preference for “consumers to refinance higher interest card debt.”

While personal loans offer flexible financial solutions, they carry inherent risks that consumers must navigate. In the event of an economic downturn, “individuals with substantial loan obligations may find themselves in precarious financial positions,” Manent warned.

The Best Option for Borrowers Seeking a Loan

To that end, while super-prime borrowers are adding personal loans, TransUnion’s data says delinquencies for the cohort has climbed. Roughly 24 percent of super prime borrowers who took out a loan in 2021 were 60 days past due (DPD), and 26 percent of super prime borrowers who took out a loan in 2022 were 60 DPD despite their annual interest rates being nearly 6 percentage points lower than the average borrower.

“If you’re a super prime borrower, your best choice in that case is a 0% balance transfer credit card,” Schulz said. “As useful as a personal loan can be, you’re not going to get a 0% offer with one.”

More broadly, Pagel said that consumer-level delinquency rates for 60+ DPD are just slightly lower than they were a year ago, at 3.75 percent, led by an improvement in the performance of originations by below-prime borrowers.

More than just a means to tide over immediate financial needs, personal loans are increasingly being used for debt consolidation, home improvements, and funding major life occurrences. “It doesn’t mean that it is the right move,” Schulz said.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Read the full article here